Sell your home fast for top dollar. Selling your home is one of the most important steps in your life. This nine steps system will give you the tools you need to maximize your profits, maintain control, and reduce the stress that comes with the home selling process;

Sell your home fast for top dollar. Selling your home is one of the most important steps in your life. This nine steps system will give you the tools you need to maximize your profits, maintain control, and reduce the stress that comes with the home selling process;

Know why you’re selling and keep it to yourself. The reasons behind your decision to sell, affect everything from setting a price to deciding how much time and money to invest in getting her home ready for sale. What’s more important to you; the money you walk away with, or the length of time you’ve your property is on the market or both? Different goals will dictate different strategies.

However, don’t reveal your motivation to anyone else or they may use it against you at the negotiating table. When asked, simply say that your housing needs have changed.

Do your homework before setting a price.

Settling on its offering price shouldn’t be done lightly. Once you set your price, you’ve told the buyers the absolute maximum they have to pay for your home, but pricing to high is as dangerous as pricing too low. Remember that the average buyer is looking at multiple homes at the same time they’re considering yours. This means that they have a basis of comparison, and if your home doesn’t compare favorably with others in the price range you said, you will be taken seriously by prospects or agents. As a result, your home will sit on the market for a long time and, knowing this, new buyers on the market will think that there must be something wrong with your home.

Do your homework. Find out what homes in your own and similar neighborhoods have sold for in the past 3 to 6 months, and research what current homes are listed for. That certainly helps prospective buyers will assess the work of your home.

Find a good real estate agent to represent your needs.

Nearly 3/4 of homeowners claim they wouldn’t use the same real estate agent who sold their last home. Dissatisfaction boils down to poor communication, which results in not enough feedback, lower pricing, and strained relations. Picking the right agent is one of those critical issues that can cost or save you thousands of dollars. It is important to find out what unique plan And programs and agents have a place to make sure that your home stands out.

Maximize your home’s sales potential.

Each year, corporate North America spends billions of product packaging design. Appearance is critical, and it would be foolish to ignore this when selling your home.

You may not be able to change your Holmes location or foreplay, but you can do a lot to improve its appearance. The look and feel of your home generate a great emotional response than any other factor. Before showings clean like you’ve never cleaned before. Pick up, straightened, uncluttered, scrub, scour, and dust. Fix everything, the matter how insignificant it may appear. Present your home to get a wow response from prospective buyers.

Allow the buyers to imagine themselves living in your home.

The decision to buy a home is based on emotion, not logic. Prospective buyers want to try on your home just like they wanted a new suit of clothing. If you follow them around pointing out improvements, or if you’re decorous so different that it’s difficult for a buyer to stripping away in his or her mind, you make it difficult for them to feel comfortable enough to imagine themselves an owner.

Make it easy for prospects to get information on your home.

You may be surprised to know that the two marketing tools that most agents used to sell homes are actually not very effective at all. In fact, less than 3% of people purchase their homes as a result of calling to a classified ads, and less than 1% of homes are sold at an open house.

Furthermore, the prospects calling for information on your home probably value their time as much as you do. The last thing they want to be subjected to is either a game of telephone tag with an agent or an unwanted sales pitch. Make sure the ad your agent places for your home is attached to a 24-hour prerecorded hotline with the specified telephone number for your home which gives buyers access to detailed information about your property day or night seven days a week, without having to talk to anyone. It’s been proven that three times as many buyers call for information on your home under the system. And remember, the more buyers you have competing for your home the better because it sets up an auction-like atmosphere that puts you in the driver seat.

Sell your home fast for top dollar – Know your buyer.

In the negotiation process, your objective is to control the pace set the duration. What is our buyer’s motivation? Does she or he need to move quickly? Does she or he have enough money to pay you your asking price? Knowing this information gives you the upper hand in the negotiation because you know how far you can push to get what you want.

Make sure the contract is complete.

For your part as a seller, make sure you disclose everything. Smart sellers proactively go above and beyond legal requirements to disclose all known defects to their buyers, in writing. If the buyer knows about a problem he or she cannot come back with a lawsuit later on.

Make sure all terms, costs, and responsibilities are spelled out in the contract of sale and resist the temptation to diverge from the contract. For example, if the buyer request to move in prior to closing, just say no. Now is not the time to take any chances of the deal falling through.

Don’t move out before you sell.

Studies have shown that it is more difficult to sell a home that is vacant. Because it looks forlorn, forgotten, simply not appealing. You could even cost you thousands. If you move, you’re also telling buyers that you have a new home. It sends a message to buyers that are probably highly motivated to sell fast. This, of course, will give them the advantage at the negotiating table.

For more posts about selling real estate, click here.

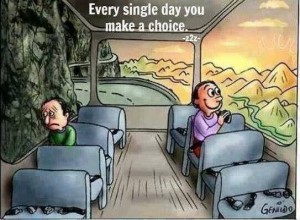

Everyone should think about maintaining a balanced life style. What does this really mean and why is it so important? It all comes down to maintaining your health over the long-term. This was explained to me by a senior manager who was providing some mentoring to me one day. I think that he thought that I was working too hard. He wanted to make sure that I maintained a balanced life style for myself and my family.

Everyone should think about maintaining a balanced life style. What does this really mean and why is it so important? It all comes down to maintaining your health over the long-term. This was explained to me by a senior manager who was providing some mentoring to me one day. I think that he thought that I was working too hard. He wanted to make sure that I maintained a balanced life style for myself and my family.