With so many people retiring over the next 20 years, many are wondering if they will have enough money to last through their Retirement. Should they keep working? Should they retire now and enjoy life? What are the questions we should ask ourselves to make sure we are ready for Retirement? We have assembled four questions to ask yourself before retiring, which many people will find challenging. It is definitely worth it to address these areas to ensure that you will achieve your objectives in Retirement. Another key recommendation is to discuss your retirement plans and the answers to these questions with your partner or spouse. They need to be on board and satisfied with the lifestyle that you both will have in Retirement. Here is a list of 4 questions that all consumers approaching Retirement should consider.

With so many people retiring over the next 20 years, many are wondering if they will have enough money to last through their Retirement. Should they keep working? Should they retire now and enjoy life? What are the questions we should ask ourselves to make sure we are ready for Retirement? We have assembled four questions to ask yourself before retiring, which many people will find challenging. It is definitely worth it to address these areas to ensure that you will achieve your objectives in Retirement. Another key recommendation is to discuss your retirement plans and the answers to these questions with your partner or spouse. They need to be on board and satisfied with the lifestyle that you both will have in Retirement. Here is a list of 4 questions that all consumers approaching Retirement should consider.

What are the 4 Questions to Ask Yourself Before Retiring

It should be pointed out that these 4 questions are all inter related. The decisions you make in one area will impact the decisions that you make in another. Consider them carefully and review the answers every 6 months to ensure you are om course to achieve your objectives.

- Will You Have Enough Money

- Where will you Live

- What will I do With My Time

- How Will Retirement Impact My Financial Life

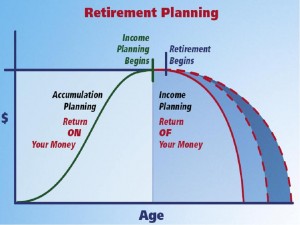

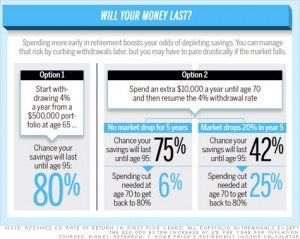

Will You Have Enough Money – Add up all the income you will receive in Retirement from pensions, savings, and even part-time jobs. How does this income compare with what you make now? Do you need to save more or work longer to meet your objective?

Where will you Live? Will you downsize or stay in your current home? Can you afford the expenses associated with your current house, such as the taxes, upkeep, regular utilities, etc.? Do you need to move to control your costs and align them with your retirement income?

What will I do with my time? Suddenly, you will have 40-plus hours a week to fill. Once you complete all of the projects around the home, golf as much as you want, travel, and get all of this out of your system, what will you do? How will your plans affect your expenses? Do you have sufficient money to do everything you want?

How will Retirement impact My Financial Life – There will be lots of changes to your lifestyle, your expenses associated with work that you no longer have etc. Take a few minutes to determine what the impacts will be on the positive and minus sides. With more time on your hands you could end up spending more money than you planned.

Revisit these questions and the answers you gave every 6 months. There will be changes and adjustments you need to make that reflect your plans and the reality of your life.

For more retirement income discussion, click here.