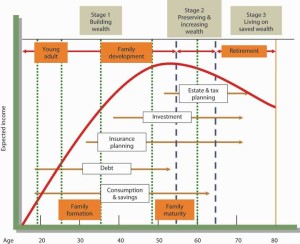

Do you know what life stage you are in financially? Many of us do not, and before we know it, we are walking out the door to retirement if we are lucky or getting laid off if we are unlucky. Â Each life stage has different requirements financially, and with good planning, you can prepare for each stage and come out ahead of the game so that when you are finally ready for retirement, you have sufficient funds for your retirement. The chart at the left depicts one writer’s view of various life stages. Most people will find that they fit into this chart at some point. You need to ask yourself where you are and are you meeting the requirements at this life stage.

Do you know what life stage you are in financially? Many of us do not, and before we know it, we are walking out the door to retirement if we are lucky or getting laid off if we are unlucky. Â Each life stage has different requirements financially, and with good planning, you can prepare for each stage and come out ahead of the game so that when you are finally ready for retirement, you have sufficient funds for your retirement. The chart at the left depicts one writer’s view of various life stages. Most people will find that they fit into this chart at some point. You need to ask yourself where you are and are you meeting the requirements at this life stage.

What Life Stage are you in Financially

Pre-marriage, pre-home, pre-kids – in other words, you are single with no commitments and probably starting your first job. Marriage, a new home, and kids – lots of expense, and your single largest purchase is during this stage. Your home will be the largest investment, and your kids will represent the largest expense. These can be difficult years with never enough money to go around for all the needed things that you would like to provide for your family.

Pre-retirement- kids are at university, you have a couple of weddings to pay for, and retirement is only a few years away. Expenses are still high due to university costs and, of course, weddings. However, your house is paid off, and you have more funds available to save and also pay your expenses.

Retired – the first few years include adjusting to not working or perhaps working part-time to fill the days. Many people will travel, the house is paid off, and you take up golf or other sports. It is an active time, and you can also enjoy the grandchildren.

Late Retirement – Time to slow down. There are a few illnesses to deal with, some friends are no longer around, you have grandkids, and you are spending more money on medical issues.

Financial Requirements for Each stage

It is a complex life with lots of demands for money as different events unfold and require money to pay for them. New cars, clothing, housing, vacation, weddings, travel, repairs and it never seems to stop.

On top of that, there are always speed bumps along the way that jeopardize your quality of life. It might be a job change, being out of work for a while, or even a medical emergency. Whatever they are, they can be dealt with proper planning and savings plans.

If you are handy with a spreadsheet and so inclined, you can develop a financial model that will help you decide how much you need to save for every area and life stage of your life. Most people are not and need a much simpler approach that has common sense and is easy to implement.

Common Sense Approach to Your Life Stages – Financially

Following a few simple rules will ensure you have sufficient funds for your needs. Putting them into action and sticking to them is much more difficult. It takes discipline and perseverance, but the result will ensure that you have a quality of life that matches your income level.

Here they are :

- Live within your salary and stick to your budget

- Set aside 10% of your income for retirement

- Save an emergency fund that is equivalent to one year’s salary

- Start early, on your first paycheck saving for retirement

- Invest in quality investments, avoid junk stocks and bonds

- Diversify; never put everything into one investment

- If it sounds too good to be true, then it probably is

- Constantly monitor your savings plan and budget

- Adjust your expenses as needed to avoid generating additional debt

- Pension plus savings should meet 90% of your pre-retirement income

- Adjust your savings plan if you fall behind – market adjustments, inflation, etc.

Discussion About Life Issues

Many people get in over their heads, as the last two years have demonstrated with all the foreclosures and bankruptcies. Consumers losing their jobs and also taking on too much debt is a really bad combination that came together at the same time.

This is the essence of the first rule or guideline. Never take on more debt than you can afford, and make sure you have sufficient emergency savings for at least a year, not counting your retirement savings. In other words, live within your means. Sure we have all heard of many people getting rich on lucky speculation in real estate or the stock market, and yes, this does happen. However, for most consumers, the slow, steady approach is the best because there are 100 who do not for everyone who gets lucky on investment.

The next two guidelines are also very important. Saving for retirement. The earlier you start, the easier it gets and the more fund you will have for retirement. Near-term emergencies will always happen throughout your life. Â They will vary by family. But rest assured they will occur, and having a savings account equivalent to at least one year’s salary could mean the difference between financial ruin and time to find another job or recover from a serious illness.

It is difficult to meet these savings guidelines. However, you will be very thankful if you take the time and the discipline to meet these guidelines if a serious disruption in your life occurs.

We will discuss these issues and others in this blog later this year. Let us know if you have comments or other ideas about how to deal with life’s curve balls.

Keep writing about retirement issues. This is good stuff because you are not trying to sell anything, no credibility issues!