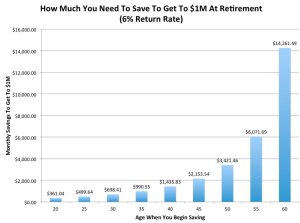

Can you tolerate investment swings in your retirement? Do you stay awake at night worrying about your investment nest egg? Do you check the stocks every day to assess the value, the direction, and the changes that are occurring in the market? If you do, you may not be good at tolerating investment risk in retirement very well. The chart on the left illustrates the relationship between risk, return, and the type of investment that can be in someone’s investment portfolio. Of course, many people want a high return. But they may not be able to tolerate the high risk associated with high returns.

Can you tolerate investment swings in your retirement? Do you stay awake at night worrying about your investment nest egg? Do you check the stocks every day to assess the value, the direction, and the changes that are occurring in the market? If you do, you may not be good at tolerating investment risk in retirement very well. The chart on the left illustrates the relationship between risk, return, and the type of investment that can be in someone’s investment portfolio. Of course, many people want a high return. But they may not be able to tolerate the high risk associated with high returns.

Tolerating investment risk in retirement!

What is the impact of swings in the market on your retirement? If the market drops by 10% do your portfolio change by the same amount? Are you invested proportionately too high in one area which if it nose dives will decimate your portfolio? Diversity is a key ingredient in retirement investments, really in any investment package. Regardless of how you invest, never put all of your eggs in one basket.

How can you manage and deal with those investment swings? One of the big tests came in 2008 when the markets dropped by more than 50% and portfolios did the same. Many people sold on the way down and never bought back in because they were too scared. They lost big time because the market has rebounded far beyond where it was pre-2008.

If you really want low-risk and do not want to worry about your investments, money markets, GIC, and cash is the investment to choose. Low income will also be the order of the day. On the other end, speculative stocks can deliver a high return, but also come with high risk. Can you afford to lose it all?

Most investment advisers recommend a balanced approach of high-quality dividend-paying stocks, mutual funds and bonds, GIC, and the Money Market. There will still be some swings, but not to the same extent that the stock market swings. In addition, you will still obtain income from the dividend and interest that you collect from the stocks and bonds, GIC, etc.

The best approach is to complete a risk assessment, work with your adviser, and take an active role in matching your investments and your retirement expenses to your risk tolerance level.