Apparently people aged 18 to 34 who have retirement savings has dropped to 39 per cent – the lowest level in almost a decade – and fully 45 per cent have not started saving for retirement yet, according to a recent survey conducted in the past few months. Regardless of the age it seems that saving for retirement is either not a priority or consumers are struggling to meet their living expenses. Young people should save for retirement.

Apparently people aged 18 to 34 who have retirement savings has dropped to 39 per cent – the lowest level in almost a decade – and fully 45 per cent have not started saving for retirement yet, according to a recent survey conducted in the past few months. Regardless of the age it seems that saving for retirement is either not a priority or consumers are struggling to meet their living expenses. Young people should save for retirement.

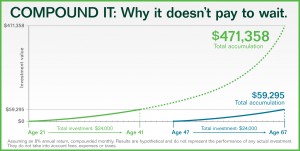

The graph above demonstrates how powerful early savings are and how much you can save if you begin early. We will talk about this subject even more in the next post, Compound it – Why It Does Not Pay to Wait.

In fact retirement savings ranked seventh as a financial priority among younger people (26 per cent). The survey found that this age group is more focused on other financial goals such as reducing or eliminating debt (56 per cent), saving for a rainy day (45 per cent) and homeownership (44 per cent).

For most young people retirement is so far away and they feel that they are invincible, that saving for retirement really takes a low priority. The fact is that it takes a lot of money to be financially independent at retirement. You also do not know what life will throw at you over the years. Early retirement, forced retirement due to layoffs and all sorts of things could leave you without the funds in your retirement years. Young People Should Save for Retirement

What is the Solution to Saving for Retirement?

There is lots of advertising by all of the banks and financial institutions. However the bottom line is that individuals have to take responsibility for their own lives retirement. The best way is to form a habit of saving for retirement. Begin early when you have lots of time and the income can help you contribute to your retirement.

For example, if you took 10% of of your income and placed it into a tax free account to save for retirement.

Benefits

There are multiple benefits to this approach, which we will list as follows:

- 10% is a relatively small amount and many people can afford to place 10% of their income in an account which they will not touch until retirement

- Use a tax free account that allows you to deduct the contribution against your income, such as a 401k in the US or an RRSP in Canada. If you are in a 25% tax bracket, the actual cost is only going to be 7.5% approximately after taxes.

- Form the habit of savings. Once you get used to saving and doing without this money, not only will you get used to not having it , many people do not even miss it.

- Income is tax free within the tax free account and over 30 or 40 years this income can add quite substantially to your total savings if you begin early enough.

- Health emergencies can occur and while consumers are urged not to touch their retirement savings for this purpose, in desperate situations the money is there to help with this expense.

- Early retirement and layoff’s will also affect how much you can save for retirement. Starting early increases the odds of saving adequately for retirement.

There are lots of benefits when you think about saving for retirement. One significant benefit is just plain peace of mind. Knowing that you will not be broke when you retire or have to work into your seventies reduces a lot of stress. It provides many people with comfort and reduced stress that also contributes to a healthy life.

Young People Should Save for Retirement Early

Starting early to save for retirement is painless. The savings will add up over the years and really amaze you. Place your saving in something that will grow and that is relatively conservative. This is your retirement. Although you have to time to recover from big losses, it is always better to invest in blue chip companies. Be diverse in your investments and monitor your investment at all times. Ensure that your retirement savings will be there when they are needed.

You Might Even Want to Retire Early

Another advantage of starting to save early for retirement is that you might even be able to retire earlier. In fact more and more people with sufficient savings and pensions are retiring early. They can travel, volunteer, help with the grand kids and do whatever they feel is important to them.

Not only do you have peace of mind. You also have a lot more flexibility to make decisions about your life style.

Retire at 49 to pursue another career. Work on a new business. Or just going to the golf course can be a great motivator to save early for retirement. Set your goals now. Develop a plan regarding how you are going to achieve those goals for retirement. Click here for more ideas about saving for retirement.

i wish someone would have told me this when I was younger. starting to save money when i was young would have been a great idea.

Hi,

I am John, a content writer and a webmaster. Today, I visited your site(http://gccihome.com/) and must say that it is awesome in terms of information provided in the content. I would like to contribute one guest post to your site. I wonder if you permit me to write for you. My article will be written on your site niche. I assure you that the article will be unique and informative for your site.

In return, You can also write one guest post for my financial sites or you can take backlinks from those sites.

Looking forward to your valuable and sincere reply.

Regards,

John Martinez

Financial writer & Webmaster

Sure, send me a proposed example and we will see were this goes