We have divided our list of things to do before you retire into two categories. First, there are the usual financial priorities that we will list in a moment. These are the ones that most people focus on. There are other areas that are nonfinancial that are also important. If you are going to truly enjoy your retirement, regardless of when you retire, pay attention to these areas as well.

We have divided our list of things to do before you retire into two categories. First, there are the usual financial priorities that we will list in a moment. These are the ones that most people focus on. There are other areas that are nonfinancial that are also important. If you are going to truly enjoy your retirement, regardless of when you retire, pay attention to these areas as well.

Financial Things to do Before You Retire

The first section is all about creating the right conditions to provide as much flexibility as you can financially. You want to enable you to do the things you want to do in retirement, whatever they are. Basically it maximizes income and minimizes expenses. Arrange a budget that helps you avoid more debt.

Pay off the Mortgage – no mortgage payment frees up all kinds of cash flow that can be used for all kinds of things. Without this burden, you have much more freedom to live in the manner you wish.

Reduce debt i.e pay off cars and loans – the same applies to loans and other debt that you may have. Pay it off, go to one car, focus on reducing your debt payments to zero. You want the flexibility of cash flow to deal with whatever comes at you later in life.

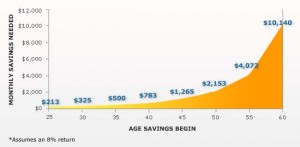

Ensure you have sufficient pension income and savings income – review your income and where it will come from. If you feel you do not have enough, added savings may be in order. Reduced expenses or even downsizing might be needed.

Minimize your expenses – we tend to be a bit frivolous with money especially the small change. Before we know it the money is gone. Watch the big and especially the small expense areas. Reduce or eliminate where possible to build cash flow. Build savings and have more free cash to do some of the really important things you always wanted to do.

Lifestyle Things to do Before You Retire

You may have all of the money that you need to live a comfortable lifestyle, however, if you are bored, not challenged or miss the social side of work there is a good chance of really not enjoying your retirement years. Focus on the following areas can sometimes help with these issues.

Create goals – for yourself, review them regularly, adjust them as needed and most important build a plan to actually make them happen, just like you might at work. This will give you purpose and something to look forward to.

Getting adjusted to Retirement – does take time and it is different for each person. Some have so many hobbies and things to do that they wonder why they ever worked while others watch the grass grow and are bored. Review all of the items in this post and figure out what is right for you and what would make it interesting for you during your retirement.

Exercise and eat in a healthy manner – to stay healthy. If you do not have your health you are not going to enjoy retirement. Your health is a precious commodity that you can lose at any time.

Travel – may not be for everyone, but if you want to travel do not put it off. There will come a time when you are unable to travel and you will wonder why you did not do it.

Live on a reduced budget – lets you sleep at night, especially when you know you have enough income and savings to live comfortably. Establish a realistic budget, track your expenses and adjust as needed.

Keep in touch with friends – having a social life is incredibly important. Never lose sight of your friends, help them when needed, and enjoy them for as long as you can.