There has long been a discussion around whether variable rate interest rates for mortgages and loans are better than a fixed interest rate for these same financial vehicles. The debate always gets interesting when interest rates are about to change. Consumers get worried, about whether they will end up paying more interest because rates are rising and they did not lock in soon enough. Conversely, many consumers also worry that they are locked in too soon when interest rates start to fall. So what is the right strategy for consumers around this huge issue of fixed vs variable interest rates? After all, it is your money.

There has long been a discussion around whether variable rate interest rates for mortgages and loans are better than a fixed interest rate for these same financial vehicles. The debate always gets interesting when interest rates are about to change. Consumers get worried, about whether they will end up paying more interest because rates are rising and they did not lock in soon enough. Conversely, many consumers also worry that they are locked in too soon when interest rates start to fall. So what is the right strategy for consumers around this huge issue of fixed vs variable interest rates? After all, it is your money.

Variable vs Fixed Interest Rates

Well, we think there are a number of factors to consider and they will vary in importance for most people. As a result, it is a very personal decision based on the financial position you are in. The plans you have for the future regarding your property and your ability to deal with risk associated with changing interest rates. We will try to discuss the major issues and provoke people to think about their situation before they make a decision. At the present time in early 2016, it looks like interest rates will stay flat for another year. You can never tell when they will change, but that is what the experts are saying at the present time.

Some Background First

A fixed interest rate loan or mortgage is just that. The interest will not change for an agreed-to time frame, usually called the “term”. At the end of the term, the bank will offer you a new interest rate and term for your loan or mortgage if you have not already paid it off.

A variable interest rate loan or mortgage will vary in relation to the prevailing bank rate announced by the Fed in Canada or the United States. If it goes up, your bank is likely to increase the rate they charge you. If it goes down, they will lower the rate they charge as well.

When the bank rate is, let’s assume 2%, then the banks will charge you one or 2 % over that level. It depends on how competitive your bank is for a total interest rate of 3 or 4%.

Factors to Consider

These factors are not listed in any relation to importance, since individual consumers may rank them quite differently based on their personal situations.

Stress – Some people just cannot deal with the unknown of whether the interest rate will change and whether your monthly payments will change or not. If it keeps you up at night worrying, why put up with that, lock it in.

Changing Monthly Payments – each time the interest rate changes, the amount of interest you owe and the corresponding monthly payment will change. As long as it is going down it is ok, however, if the interest rate is going up and there is going to be a significant impact on your budget, then you may want to switch to a fixed interest rate loan or mortgage.

Planning to Sell –

When you sign up for a fixed-rate mortgage you are saying that you will pay a certain amount for the life of the term based on the agreed-on interest rate. If you plan to sell during that period of time and the interest rates have fallen, the bank is going to charge you a penalty plus administration fees to discharge the mortgage when you sell your home. The penalty will roughly amount to the difference in your rate and the rate that the bank will lend the money out at the time you close. This can amount to thousands of dollars, so it is a good idea to think about this.

With a variable rate mortgage often you will only pay the administration fees to discharge the mortgage.

Saving Money – Variable rate loans and mortgages often have lower interest rates than the fixed rate loans and mortgages being offered by banks. This is only true at the time you take out the mortgage. Interest rates do change and they can go up and down, however, at the time you sign, the variable interest rate is usually lower than the prevailing fixed interest rates. This is an excellent way to save money especially if you feel that for the foreseeable future, interest rates are not likely to change much.

Volatile Interest Rates –

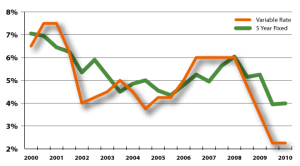

In periods of high inflation or in periods of economic downturns and depressions/recessions, the interest rate that is quoted by the banks can change often. During periods of economic growth and high inflation interest rates tend to rise. During recessions and depressions, interest rates tend to decline in order to stimulate the economy and get things moving.

Consumers should take this forecast of interest rate volatility into account when they are making their decision along with the other factors mentioned as part of their decisions to take a variable or fixed interest rate loan or mortgage.

Competitive Rates – Many newspapers will list current interest rates offered by banks and other lending institutions each week. For the most part, they are all pretty close since competition is pretty fierce, however, it never hurts to have a discussion with your loan officer to see what kind of deal they may give you.

Sometimes even shaving a quarter percent off can make a big difference in the total amount of interest you pay. It never hurts to ask and the worst that will happen is that they will say no!

In Summary

Assess your risk tolerance for changing interest rates. Assess the impact on your monthly payments. In addition, assess your plans to sell or keep your home over the next several years. Also, where do you anticipate interest rates are headed as inputs to your decision? Note that you can and should compare fixed and variable interest loans and mortgages from various companies to ensure that you obtain the most competitive rates.

Thirty percent of Americans 65 years and older are carrying a mortgage into retirement. They are also trying to figure out how to handle the payments. No one really wants to carry a mortgage into retirement. However in many cases it can just not be avoided. There may be health issues that take a lot of money. There might have been a divorce or separation. Also there may be children’s education to pay for. Or maybe you just spent too much and did not plan properly.

Thirty percent of Americans 65 years and older are carrying a mortgage into retirement. They are also trying to figure out how to handle the payments. No one really wants to carry a mortgage into retirement. However in many cases it can just not be avoided. There may be health issues that take a lot of money. There might have been a divorce or separation. Also there may be children’s education to pay for. Or maybe you just spent too much and did not plan properly.