What are the signs and symptoms of baby boomer elder abuse? They are many. Anyone who is providing care, or is a friend or a family member of the senior needs to be on the alert. Often the most visible are bruises that really should not be there. Falls take place sometimes causing broken bones. When someone falls, they can cause bruises as well. But if there is no fall and the senior you are visiting has a lot of bruises, investigate what is going on.

What are the signs and symptoms of baby boomer elder abuse? They are many. Anyone who is providing care, or is a friend or a family member of the senior needs to be on the alert. Often the most visible are bruises that really should not be there. Falls take place sometimes causing broken bones. When someone falls, they can cause bruises as well. But if there is no fall and the senior you are visiting has a lot of bruises, investigate what is going on.

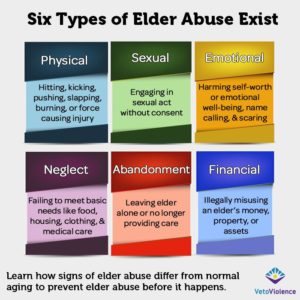

Another common form of elder abuse is financial, which is the focus of this web site. Financial abuse takes place when there is outright stealing. Seniors pay for things that they really should not pay for or they are paying too much for many items. Often care givers, whether they are family members or not, cannot resist the monetary attraction. Relatives should jointly monitor the seniors funds. They need to make sure that their savings are not being prematurely spent, leaving them destitute.

From a Financial Perspective

Uncovering financial Elder abuse is difficult. Regardless of the amount of savings and investments that a senior might have, family members should always monitor what is being spent. Investigate unusual amounts or one time large amounts that you are not familiar with.

More than one person should check accounts and spending levels. Money can corrupt no matter who it is. Two people, must monitor accounts. There will be less chance of collusion and financial elder abuse.

Elder financial abuse can come in many different forms.

One time while cutting my father in-laws lawn, a person drove in to the yard. He indicated that he was here to collect the monthly fee for the newspaper. The amount was around $45. I asked him how long he had been delivering the paper? How long he had been collecting cash from my father inlaw? This gentleman was around his mid 40’s. He said he was relatively new, but it had been several months since he started collecting.

He gave me his name and his license number. Then I informed him that I had prepaid the subscription for the paper. He quickly realized that the jig was up. He left before I could say much more. What a scumbag. Taking money from the elderly. It was a small amount but still it makes him a scumbag.

I called the news paper. The news paper fired him. However he likely has continued ripping seniors off and is taking money from unsuspecting seniors.

The point of the story is that everyone must be alert. There are thieves everywhere. The elderly are particularly vulnerable. If you have an elder person you are close to, help protect them.