With so many people retiring these days we thought we should do a series of posts about retirement planning and retirement planning options. More people will be retiring than ever before and it is all due to the baby boom group reaching the magic age of retirement. Some will retire at 50, while others will work well into their late 60’s or even into their seventies depending on their financial situation as well as their personal objectives.

With so many people retiring these days we thought we should do a series of posts about retirement planning and retirement planning options. More people will be retiring than ever before and it is all due to the baby boom group reaching the magic age of retirement. Some will retire at 50, while others will work well into their late 60’s or even into their seventies depending on their financial situation as well as their personal objectives.

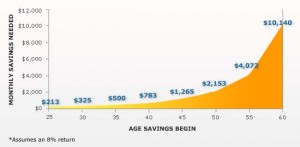

If there is one message that you should take out of this post, it is “plan for your retirement!†This can take many different aspects so that is why it is important to begin early, develop several retirement plan options and be prepared to adjust them over time, to select one over the other, and even change them completely based on whatever life throws at you. The important thing is to have a plan, develop the things you need to do to make that plan happen, and then take the action to achieve your plan.

Complete a Financial Plan

Either do this yourself or have a financial adviser do it for you. The data you will need includes:

- Planned retirement date

- Current savings

- Current debt

- Present living costs

- Living costs first year of retirement

- Living cost in subsequent years of retirement

- Special costs and expenses that you know about

- Planned trips, expenses, etc that must be considered

From this plan, you will quickly know how much more money you need to save to achieve the level of income you will need to live in the style that you would prefer while retired. You may also have some idea of the quality of life you will experience and the things you will like to do wild retired. You cannot sit in front of the TV all day or your health will decline and you will become extremely bored. Planning for retirement and developing retirement plan options is includes financial as well as the lifestyle that you will need.

Test Drive Your Retirement Plan Options

This is an interesting challenge for many people. If you know how much you will have to live on each year during retirement and have worked this out with your investment planner, why not test drive your plan. Take six months or a year, and attempt to live on whatever income you feel that you will have during your first year of retirement.

This can be an interesting exercise for many people who have no idea of how much they need during retirement. If you are going to be short of money, you will quickly understand and the reality check will help to confirm what you need to do to avoid getting into the situation of retiring without enough money to live on or at least live to the level that you prefer. Test each of your options this way to really make sure that your plans will be realistic.

Retirement Plan Options to Consider

There are many options and they will differ for many people based on their savings, their income, and their preferred lifestyle. The following are a few issues to consider as you develop options and try to make up your mind on what the best course of options is correct for you:

- Be conservative in all of your assumptions, you will be pleasantly surprised

- Diversify your investments

- Invest in high-quality investments and avoid chasing high-risk yield

- Hire an investment advisor

- Never relinquish control

- Assess your plan every year to recheck and adjust as needed

- Work longer if needed to ensure that you have benefits or income or both

- Cut down on expenses where ever you can

- Develop the main plan which is the preferred plan and at least two others that include

- A plan that is much more aggressive in term of income i.e. +20%

- A plan that is much more aggressive in terms of expense I.e. +20%

Develop your retirement plan options using these types of guidelines, recheck every year, and adjust as needed. Be prepared for change and be prepared to keep on working or go back to work to help your plan out if the economy for example does not cooperate e.g. interest rates are low and will remain low, limiting your income as a result.