This is the key question for many middle-aged people and seniors who are contemplating joining the retired ranks, “will my money last through my retirement years”? The baby boomers are retiring and we see various statistics that show that some people have lots of money saved while others know they will have to work well past the normal retirement age just to buy food and live somewhat comfortably!

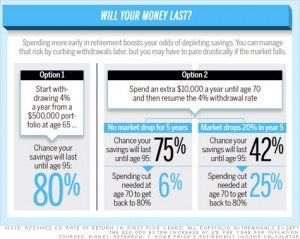

We recently came across a post on CNN Money recently that really caught our attention and although we are not republishing it here, we are reposting an image that was in the article since it was so clear about the issues we are all wondering about.

Will My Money Last Through Retirement

How Much Money do You Have

The first assumption is that the retired person has $500,000 when they retire at age 65. The column on the left assumes that you withdraw 4% each year. Which is only $20,000 and concludes that you have an 80% chance that your money will last until age 95. They do not state what assumptions were made regarding income rates and stock market performance.

Option 2 assumes that you take an extra $10 k out for the first 5 years, with market drops assumed in the far right option. While the percentage probability decreases that you will make it to 95, it also assumes that you must take a spending drop after age 70. This may be a reasonable assumption since most of us will be less active after age 70. This is part of the normal aging process. Why not spend our money while we can enjoy it is the motto of these two plans!

Some people would say they were loaded if they had $500,000 in savings. They would not spend a second more thinking about the issue. While others would feel that they were vastly underfunded. They would continue working and saving until they either had what they felt they needed or were forced to stop work due to poor health.

How Long Will Retirement Funds Last

The answer is that all of us must figure out what we need on an annual basis to live on. Some can get by very nicely on $30,000. While other people feel that they would need at least $100,000 a year to live. Don’t forget to also take into account all of your income from other pensions and old-age benefits. If you are happy today living on $30,000 chances are you will be satisfied with the same amount while you are retired. Figure out how much you need to live on each year. Then figure out how much you need to save to generate this income.

Assume that you will withdraw 4% each year. Also that you need $30,000 a year from your savings to add to any pension income. Divide 30,000Â by 4% to get $750,000 of savings that you will need using the 4% option. You still have an 80% chance of making it to 95 with sufficient income to live on.

This is a good exercise for anyone thinking of retiring and living off their savings plus their pensions. Whether it is a company pension and/or old age pensions. If you do not have a pension, then you must rely totally on your savings to live on into retirement. On the other hand, if you have an excellent pension, you may not have to be concerned at all about how you spend your savings. This is a very personal decision. Every situation will be different for every person or couple thinking of retiring.

Build Your Own Retirement Model

Personally, I built a spreadsheet with my age, my savings, and an assumed growth rate every year. Then I added an assumed withdrawl rate every year. Once the model was built I can easily change the percentages to look at the impact of various scenarios. This is an excellent tool, It brings to light what I needed to do to develop a winning situation. One that would ensure that not only do I have enough money. But I also identified the steps I need to take to improve my situation.

If you are not familiar with spreadsheets ask a friend who can set it up for you and show you how to manipulate the variables. It is definitely worth the time it takes and you will have peace of mind as well.

Feel free to write us a comment or two about your retirement dilemma and what your solution is to deal with your concerns.