You have spent years saving for retirement and now you have a nice little nest egg set aside to augment your Company pension and your government pensions. How is your portfolio doing overall and do you have enough saved for retirement?

You have spent years saving for retirement and now you have a nice little nest egg set aside to augment your Company pension and your government pensions. How is your portfolio doing overall and do you have enough saved for retirement?

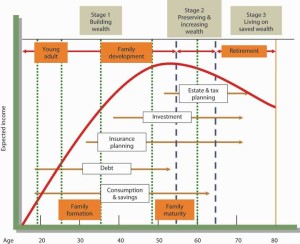

You still wonder whether you will have enough saved to last through your lifetime in retirement. You also wonder how you’re doing relative to meeting that objective. There are several ways to compare your progress in your portfolio. We will review three of those methods in this post.

How is your portfolio doing

Capital preservation

Some people will have an objective of living only on their interest income and dividend income. They can do this if the portfolio generates enough income and not touch the principal. Many advisers support this approach. One must be careful and not chase high-risk investments to generate income.

The odds are high that you will also have to dip into your principal at some point during your life. However this is a simple approach to assessing your portfolio health and if you can live on interest and dividend income alone along with your pensions you’re well on the way to living comfortably in your retirement.

Meeting a projected rate of return

In this approach you set a rate of return objective and assess whether you’re able to meet or exceed this objective at the end of each year. Some people will consider the plan a failure if you fall short of that goal.

Again this is a simplistic approach and some people may chase higher rate bonds and dividends in order to meet their objective which incurs more risk.

The balance sheet

Another approach and more complicated is to assess your balance sheet at the end of each year. This requires that you take the present value of all of your pension income, dividends and bond interest income and calculate a number. You do the same thing with your liabilities and compare your assets to your liabilities.

As long as your assets minus liabilities are the same each year or increasing you’re doing well. You must also include a factor for inflation to calculate your expenses in today’s dollars. You must also figure out just how long you expect to live.

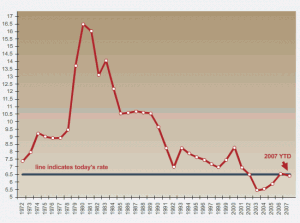

Inflation factor can be 2.5% to 3% based on the past 20 years or so of inflation. Figuring out how long you’re going to live is a bit more complicated. Probably the best way is to look at your immediate family, mother, father, uncles etc. Pick an average based on how long they have lived.

We believe that you should use a combination of all three of these methods and reassess your situation anytime there is a major change in your financial, health, or personal situation to access if you’re still on target. At the minimum reassess how your portfolio is doing once a year and make any adjustments that you feel would be appropriate to ensure that you have the income that you will need in your retirement.

Save

We decided to select our first topic, Stock Market Volatility and Retirement, based on what is going on this week in the world’s stock markets because the volatility affects so many people. We are not stock market experts, just a writer that is informed and giving our own opinion.

We decided to select our first topic, Stock Market Volatility and Retirement, based on what is going on this week in the world’s stock markets because the volatility affects so many people. We are not stock market experts, just a writer that is informed and giving our own opinion.