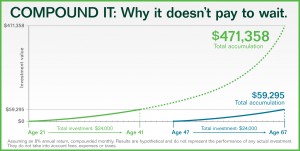

This graph emphasizes why compounding interest works and why it does not pay to wait to begin saving. Compound Interest strategies can really make a difference in your retirement lifestyle. A person who begins saving at age 21 and saves a total of $24,000 by age 41 and assuming an 8% return on the investment which is reinvested will yield a total savings of $471, 358 by the age of 67. That is a lot of money and only based on savings of $24,000 by age 41. In reality, this person will probably continue saving all his or her life and accumulate much more than this already large amount. However the point of this post is really about what someone who begins later in life and how much money they will actually have at age 67.

This graph emphasizes why compounding interest works and why it does not pay to wait to begin saving. Compound Interest strategies can really make a difference in your retirement lifestyle. A person who begins saving at age 21 and saves a total of $24,000 by age 41 and assuming an 8% return on the investment which is reinvested will yield a total savings of $471, 358 by the age of 67. That is a lot of money and only based on savings of $24,000 by age 41. In reality, this person will probably continue saving all his or her life and accumulate much more than this already large amount. However the point of this post is really about what someone who begins later in life and how much money they will actually have at age 67.

The graph above assumes someone begins saving much later in life at age 47, which unfortunately is when many people begin saving. This is the time when they suddenly realize that retirement is not far away and they do not have enough money saved for retirement. If this person began saving at age 47 and saves the same $24,000 by age 67. Including the average 8% annual return, this person will only have %59, 295 saved. Not very much for retirement and they are already 67. They are looking at many more years of working unless they have a pension to make up the income they need.

Starting to Save for Retirement Late is Scary – Compound Interest

For those of you who are reading this post and fit into the latter category, it will be a scary thought to wonder how you are going to survive on so little savings. It is going to be tough unless you can continue to work for many more years. Let’s face it, most of us do not want to work that long unless we really love our jobs.

In both cases, both parties saved $24,000 over a period of 20 years. However, the younger person began saving much earlier and so compounding continued for many more years and created much more wealth!

This is the main reason why we are so strong in suggesting that people begin early to save. There will be many market fluctuations along the way and some investments might not do so well, however, when you combine the growth of value for your investments combined with the income they generate, you will be much further ahead and closer to your retirement goals. The income should always be reinvested to earn additional income.

How difficult is it to Save $24,000 over Twenty Years?

Just doing the simple math i.e. dividing $24,000 by 20 to get the amount you need to save per year and then dividing by 52 to obtain the amount you need to save each week brings us to the huge sum of $23 a week. This is not a huge amount. Most people will spend much more than this amount on whatever vice they have. Whether it is cigarettes, fancy coffees, drinks at the local bar, or whatever happens to be your particular interest, you can easily set aside $23 a week to save this kind of money by the time you are 67.

Imagine< $451 thousand by the time you are 67 and all you had to do was save $23 a week for twenty years beginning at age 21. chances are you will be able to save much more than that by saving a great deal more as your jobs pay more and your income grows. If you save 10% a year, or 10% a paycheck you will quickly be able to achieve these large numbers. You should be able to retire much younger than perhaps you have planned.

But I am too young to even Think About Saving for Retirement!

This is what most people say. They have too many other bills to pay. They are having too much fun. Also, they can worry about retirement later if they make it that far. Many people do make it that far. They also find that they have to work much longer than they planned just to live.

It is so simple. Just start saving now. Figure how much you need or want. How many years you have left before you want to retire? Use a number like 8% return on average to calculate how much money you need to save for retirement each week. If you do not know how to make this sort of calculation, sit down with a financial adviser. Ask him or her to do the calculation for you. You might be surprised how little you need to get started and save every week.

Once you start, it will quickly become a habit. You will not even miss the money and your future will be assured! And compounding interest will help you achieve your goals! Just aim for compound interest solutions!