This is an entire repost from Sun Life Financial. We thought our readers would find this interesting. We are doing many posts about retirement and looking for different viewpoints. This is about Life After Age 65. Men and women have different views of life after 65; Sun Life Financial study finds

This is an entire repost from Sun Life Financial. We thought our readers would find this interesting. We are doing many posts about retirement and looking for different viewpoints. This is about Life After Age 65. Men and women have different views of life after 65; Sun Life Financial study finds

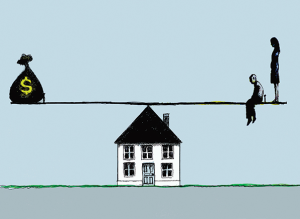

Does the “Men are from Mars, Women are from Venus” idea fit when it comes to retirement?

Life After Age 65 – the Article

TORONTO, Jan. 21 /CNW/ – The gender gap seems to have extended into Canadians’ views of retirement, with twice as many men (32 percent) than women surveyed saying they want to work past age 65, according to the second edition of the Sun Life Canadian Unretirement(TM) Index.

“We also found that men and women had diverse opinions around what factors should be considered in a retirement plan, with women more likely to cite long-term care, low-interest rates, and death of a spouse,” said Kevin Dougherty, President, Sun Life Financial Canada. “Interestingly, Canadians, on the whole, were significantly more confident about their retirement if they had worked with a financial advisor for a year or more than those who did not have an advisor.”

Other Findings

Other survey findings show that men and women think differently about financial planning and confidence in retirement:

– Seven in 10 women (71 percent) who said they will be working past

age 65 said they will be doing so to earn enough money to pay for

basic living expenses compared to 65 percent of men. More women

(61 percent) also believed their company pension would not be enough

to live on compared to men (56 percent).

– Forty-nine percent of Canadian women surveyed were very confident

they would have enough money for basic retirement living expenses

compared to 57 percent of men.

– Twenty-nine percent of women were very confident they would have

enough money to enjoy the lifestyle they want compared to 36 percent

of men.

– Women tended to be less confident about the overall economy and their

personal finances compared to men.

“Women have substantial reasons for worrying that they won’t have enough money to enjoy the lifestyle they want in retirement,” said Alison Konrad, Professor of Organizational Behavior at the Richard Ivey School of Business, University of Western Ontario. “The average Canadian woman earns about 66 percent of what the average Canadian male earns. So even though women tend to put a larger percentage of their income into their retirement nest eggs, men save almost $1,900 more each year.”

Measuring Canadians’ overall retirement confidence

The Sun Life Canadian Unretirement(TM) Index measures Canadian workers’ confidence towards issues that influence retirement. The lower the index number, the more negative or pessimistic the outlook is on issues that influence retirement.

This second of multiple studies yielded an overall index score of 51 on a scale of 0 to 100, compared to a score of 50 in December 2008. This compares to the American Unretirement(SM) Index score of 44.

Confidence levels were significantly higher for Canadians who worked with a financial advisor. The overall index score was 51 for all working Canadians surveyed. Those who did not have an advisor scored 48, while those Canadians surveyed who have worked with an advisor for a year or more were much more confident, scoring 54.

The Index is a blend of confidence scores in five sub-indices: Macroeconomics (score = 40), Government Benefits (score = 47), Personal Finance (score = 49), Employer Benefits (score = 47), and Health (score = 70).

Which of these describes what you think you will be doing at age 66, shortly after the normal retirement?

-------------------------------------------------------------------------

Women Men Women Men Women Men Women Men

--------------------------------------------------------

30 to 30 to 40 to 40 to 50 to 50 to 60 to 60 to

39 39 49 49 59 59 65 65

-------------------------------------------------------------------------

Working full time 7% 13% 13% 17% 13% 21% 15% 32%

-------------------------------------------------------------------------

Working part time 24% 29% 19% 31% 26% 35% 31% 36%

-------------------------------------------------------------------------

Fully retired/

not working for

money 68% 57% 68% 51% 59% 43% 53% 31%

-------------------------------------------------------------------------

No longer living 1% 1% 1% 1% 2% 1% 1% 1%

-------------------------------------------------------------------------

What should a retirement plan address?

-----------------------------------------------------------

Women Men

-----------------------------------------------------------

Won't have money to leave to heirs 42% 37%

-----------------------------------------------------------

Changes in marital status 48% 37%

-----------------------------------------------------------

Family members have unforeseen financial

needs 54% 50%

-----------------------------------------------------------

Financial market risk 60% 58%

-----------------------------------------------------------

Death of a spouse 67% 56%

-----------------------------------------------------------

My rate of return won't be high enough 66% 59%

-----------------------------------------------------------

Employment risk - job market or personal

health problems 65% 59%

-----------------------------------------------------------

Employer health benefits stop when I stop

working 62% 63%

-----------------------------------------------------------

Money will be locked in when I need it 66% 64%

-----------------------------------------------------------

Low interest rates 71% 60%

-----------------------------------------------------------

Money won't last my full lifetime 67% 64%

-----------------------------------------------------------

Long-term care needed 72% 60%

-----------------------------------------------------------

Poor health results in extra costs or

care needed 71% 68%

-----------------------------------------------------------

Inflation 79% 71%

-----------------------------------------------------------

Methodology

The study was conducted by Fleishman Hillard from August 17, 2009, to September 9, 2009. Telephone interviews were conducted by Interviewing Service of America using a random-digit-dial (RDD) sampling method. Quotas and weights were applied to gather a sample of 1,202 people working either full- or part-time, representing the Canadian working population between the ages of 30 and 65. The sample was also representative in terms of gender and region census break. Analysis and construction of indexes involved the application of factor analysis. Final indexes are based on summated averages across the attributes which make up an index.

Age groups were divided by workers in their 30s, 40s, 50s, and 60+ and by three ranges of total assets, not including the net worth of the person’s place of residence (less than $100K, between $100K and $500K, and greater than $500K). This sample has a margin of error of plus or minus three percent at the 95 percent confidence interval.

very interesting web site, the web needs more like this. i have bookmarked it and will come back

Has anyone read ‘The Great 401k Hoax’? Written by a fomerr chief editor of Businessweek mag, William Wolman, the central premise of the book is that public companies simply will not have enough profits to support investors’ retirements. Stocks are ultimately a claim on the earnings and assets of companies which do not justify current price levels. Also, retiring boomers will face falling equity prices due to falling demand for equities due to slower population growth.Consider this – the whole 401k program is designed to boost demand for stocks and thereby boost stock prices while having no effect on the corporate earnings. So you pay more for the same amount of earnings.