The baby boomers are retiring by the thousands. Some are retiring of their own free will, while others are being forced out of the door. Some are taking up new hobbies. While others are following hobbies that they gave up while raising a family and following their career. There are many options and activities that consumers who are retiring can consider. We thought we would review a few of these Retirement Planning Options in this post to provide readers with some ideas. If you are following a retirement plan or option that we missed, feel free to leave us a comment and we will add it to the list.

The baby boomers are retiring by the thousands. Some are retiring of their own free will, while others are being forced out of the door. Some are taking up new hobbies. While others are following hobbies that they gave up while raising a family and following their career. There are many options and activities that consumers who are retiring can consider. We thought we would review a few of these Retirement Planning Options in this post to provide readers with some ideas. If you are following a retirement plan or option that we missed, feel free to leave us a comment and we will add it to the list.

Retirement Planning Options – What to Do?

Volunteer – a lot of people are satisfied financially, but they cherish helping and being with people. Volunteering meets these objectives and gets them out with other people of like-minded ideals. Sometimes a volunteer position leads to a full-time job.

Start a New Career – you may have work in one industry, but have always wanted to try something different. Whether you retire on your own or are forced to retire ahead of their schedule, this is the time to follow and develop that new career.

Start a small Business – some will begin a new business. There are literally thousands of small business ideas to follow and try out. Be careful to manage your money. Avoid sinking all of your retirement funds in a business that does not give the returns you are looking for.

Look after the Grandkids – some parents help their kids by babysitting the grandkids. This keeps them active, they help out their own kids and they may even make a little bit of money out of the activity as well. It is a great time to bond with their grandkids.

Work Part Time – is another situation that provides some extra money. It also keeps you in the workforce and gets you out fairly often. You still have some time to do many of the other things we discuss on this list.

More on Retirement Planning Activities

Travel – can be expensive. However, if you manage the travel costs, make it your job to find the deals and travel smart. You can virtually travel the world without spending a fortune. Don’t put it off, you never know when you will be forced to limit your travel due to health reasons.

Focus on Hobbies – one person we know loved to buy small appliances, repair them, and resell them. It was a hobby at first, but then it turned into a small business opportunity. Which helped to pay for his tools and some of his expenses.

Focus on Your investments – if you have retirement savings, it is important to manage them, rebalance once per year or when major positions change, ensure that you are diverse in your investments, and decide when to use the money during retirement.

Help the Kids – everything from renovations, to helping the kids with moving and odd jobs around the house.

Move to a New Location – many people will downsize and move to another city to be near family etc. Although this is a short term project, it does take a lot of planning and organization to move from one house to another.

Renovate Homes – buy a house at a low price, renovate it and resell it. This sort of project can be risky, however, if you are a handyman at all, money can be made if you purchase a home at the right price, upgrade it and resell it.

Work for your Kids – if your kids have their own business, why not work for them. You can choose to be paid or just help them out. Either way, you will have lots to do and you get to spend more time with your children.

All or Some of the Above

Regardless of what you do it is important to have a plan. Some people will even start out with one idea and then switch to another based on their experience and enjoyment. Many will be doing some or all of the above at the same time. One thing we know for sure is that by taking up some or all of the above, you will never be bored or wonder what to do next. For more information about retirement planning, click here.

Save

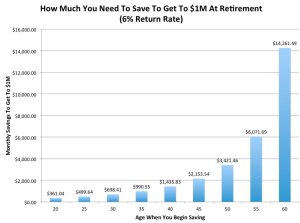

How much do you need to save every week or month to become a retirement savings millionaire? Most people cannot even dream of saving this much money or ever having a million dollars, yet many consumers do it all of the time because they have focused on managing their money in such a way that they are able to deal with all of their expenses and still save money. In this post we will do a few calculations to show you just how easy it is to become a retirement millionaire and also the major advantage of starting early in life to save for retirement.

How much do you need to save every week or month to become a retirement savings millionaire? Most people cannot even dream of saving this much money or ever having a million dollars, yet many consumers do it all of the time because they have focused on managing their money in such a way that they are able to deal with all of their expenses and still save money. In this post we will do a few calculations to show you just how easy it is to become a retirement millionaire and also the major advantage of starting early in life to save for retirement.