There are lots of challenges in retirement. Many people retire without enough money, health issues, and family issues to deal with. Still, many people can have a great retirement if they properly planned and saved enough money. Unfortunately, many Retirees are broke due to poor savings while they were working. Sometimes there are uncontrollable events in their lives, and they need to provide support to their families.

There are lots of challenges in retirement. Many people retire without enough money, health issues, and family issues to deal with. Still, many people can have a great retirement if they properly planned and saved enough money. Unfortunately, many Retirees are broke due to poor savings while they were working. Sometimes there are uncontrollable events in their lives, and they need to provide support to their families.

Challenges in Retirement – Stress in Retirement

Not having enough money to live comfortably in retirement causes a great deal of stress during what should be the best years of their lives. Without sufficient funds to live on, wondering where food is going to come from or how you will pay for it, and going to secondhand stores it can be very difficult for many seniors. North America is not exactly a senior-friendly continent as compared to other locations such as Europe. We do not seem to value our seniors in the same manner that they do in Europe and as a result, many are struggling with a great deal of stress in their lives.

Loneliness in Retirement

Not having sufficient money during retirement with family often many miles away it can get quite lonely in retirement. Unless they live in a neighborhood where people have lived all their lives, they have friends to socialize with many seniors find themselves unable to get out to be with friends and socialize.

Ignoring Health Issues

Lack of money also means that they tend to ignore health issues. If there is insufficient insurance to pay for health coverage many health-related issues will be ignored until it becomes an emergency. Older age seniors develop life-threatening issues just because they do not have sufficient funds to pay for health costs.

Worry about Health costs

There is a constant worry about how they’re going to pay for health-related costs. Even a visit to the doctor or the dentist may add additional stress and aggravate an already existing health condition. Insufficient savings or insufficient health coverage can lead to stress-related health issues. Ignoring health issues can also cause more serious issues to develop.

More Retirees are Working

As a result of all of the above, we are seeing more and more retirees going back to work. They may choose to work at part-time jobs that pay minimum wage but at least they are getting out and making some money to put food on the table. This income along with meager savings that they may have and in a few cases provides healthcare coverage allows them to live a better life.

Still Getting Frisky

Another interesting fact is that many seniors are still getting frisky with the opposite sex even though they may be getting up in years. Recent articles in the news have referred to seniors partying and dancing and leaving for extracurricular activities. This is great news and will keep everybody healthy.

Moving in With the Kids

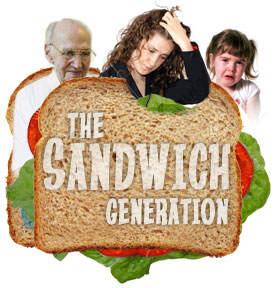

In some cases when one spouse passes away, the other spouse will move in with the kids. If there is insufficient room in the home, this can lead to lots of stress for everybody. In some cases, your mom or dad will integrate well with your family until health-related issues crop up.

Traveling is a Dream

And for many seniors traveling is actually a dream that they dream about while they were still working but sadly are unable to fulfill that dream once they retire due to insufficient funds. They have enough to live on, in some cases comfortably but not the extra money that they need to travel and see the world the way they anticipated. This is a sad reality that sinks in a few years after they retire.

Targets for Scammers

Many seniors are also targets for scammers. It’s an unfortunate aspect of our society. With lots of sales pressure placed on seniors, they often will separate them from their money leaving them in an even worse situation than they were before. This is a terrible reality.

With all of these challenges and retirement, it is still possible to enjoy retirement and make the most of your life regardless of the situation.

Imagine that you have just turned 80 and are about to lose your driver’s license. Or perhaps you have lost your confidence to drive around the city. Would a self-driving car be of interest to you in this situation? Boomers are retiring by the thousands and they are aging as well. It turns out that the market futurists feel that Boomers fueling Self Driving Car Interest is the next big thing. It makes sense. If these cars can actually drive around the city, take you to your destination and find a place to park, what a release of freedom it will be for many that must give up driving a car.

Imagine that you have just turned 80 and are about to lose your driver’s license. Or perhaps you have lost your confidence to drive around the city. Would a self-driving car be of interest to you in this situation? Boomers are retiring by the thousands and they are aging as well. It turns out that the market futurists feel that Boomers fueling Self Driving Car Interest is the next big thing. It makes sense. If these cars can actually drive around the city, take you to your destination and find a place to park, what a release of freedom it will be for many that must give up driving a car.